Navigating the Venture Capital Landscape: Insider Tips for Silicon Valley Startups

Venture capital (VC) funding can be the lifeblood of a startup, especially in Silicon Valley, where innovation thrives. However, securing VC funding is a complex process that requires careful navigation. In this guide, we’ll delve into insider tips for Silicon Valley startups to successfully navigate the venture capital landscape.

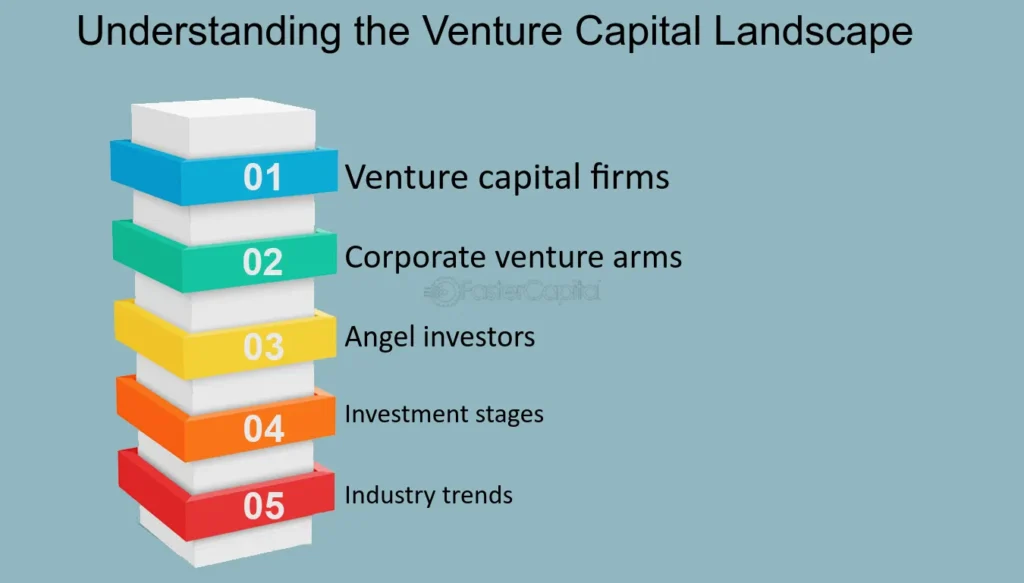

Understanding the VC Ecosystem

Before diving into the world of venture capital, it’s crucial to understand the ecosystem. Venture capitalists are investors who provide funding to startups and early-stage companies in exchange for equity. They typically invest in high-growth potential businesses with innovative ideas and strong teams.

Key Players in the VC Landscape

- Venture Capital Firms: These firms manage funds provided by investors and deploy capital into startups.

- Angel Investors: Individual investors who provide funding to startups, often in the early stages.

- Corporate Venture Capital: Investment arms of established corporations that invest in startups relevant to their industry.

Your pitch is your opportunity to make a strong impression on potential investors. It’s essential to craft a compelling narrative that clearly communicates your vision, market opportunity, and why your startup is poised for success.

Elements of a Winning Pitch

- Problem Statement: Clearly articulate the problem your startup is solving.

- Solution: Explain how your product or service addresses the problem.

- Market Opportunity: Demonstrate the size and growth potential of your target market.

- Team: Highlight the expertise and experience of your founding team.

- Traction: Provide evidence of traction, such as user growth, revenue, or partnerships.

Building Relationships with Investors

Building relationships with investors is key to securing funding. Attend networking events, conferences, and pitch competitions to connect with potential investors. Building rapport and trust takes time, so start early and maintain consistent communication.

Tips for Building Investor Relationships

- Do Your Research: Research investors’ backgrounds and interests to tailor your approach.

- Follow Up: After meeting with investors, follow up with personalized messages and updates.

- Be Transparent: Be honest about your startup’s progress, challenges, and goals.

- Listen Actively: Listen to investors’ feedback and incorporate it into your strategy where appropriate.

Negotiating Term Sheets

Once you’ve garnered investor interest, you’ll enter the negotiation phase, where you’ll discuss terms and conditions of the investment. Understanding term sheet terms and negotiating effectively is crucial to securing favorable terms for your startup.

Key Considerations in Negotiations

- Valuation: Determine a fair valuation for your startup based on market comparables and future potential.

- Investment Amount: Negotiate the amount of funding needed to achieve key milestones.

- Rights and Preferences: Understand investor rights, such as board seats, liquidation preferences, and anti-dilution protection.

- Governance: Clarify governance structure and decision-making processes.

Conclusion

Navigating the venture capital landscape can be challenging, but with the right strategies and insights, Silicon Valley startups can increase their chances of securing funding and achieving success. By understanding the VC ecosystem, crafting compelling pitches, building investor relationships, and negotiating effectively, startups can position themselves for growth and innovation.

FAQs (Frequently Asked Questions)

- How do I find the right investors for my startup?

Research venture capital firms and angel investors that specialize in your industry or niche. Attend networking events and leverage your existing connections to get introductions. - What should I include in my pitch deck?

Your pitch deck should include slides that cover your startup’s problem statement, solution, market opportunity, team, traction, business model, and financial projections. - How can I stand out among competing startups?

Focus on what makes your startup unique, whether it’s your technology, team, market opportunity, or traction. Articulate a clear value proposition and demonstrate why investors should believe in your vision. - What due diligence should I conduct on potential investors?

Research investors’ track records, reputations, and investment philosophies. Speak to founders who have previously worked with them to get insights into their investment style and decision-making process. - What are some red flags to watch out for during negotiations?

Watch out for overly aggressive or one-sided terms in term sheets, investors who exhibit a lack of understanding or interest in your business, and any inconsistencies or lack of transparency in communications.